Calculating and Claiming Meal Expenses as Flight/Cabin Crew (Canada)

Disclaimer: I am not an expert on tax or accounting. You should consult a tax professional before making any financial decisions. Refer to the Terms and Conditions for more information.

Updated June 2017

In Canada pilots and cabin crew are able to claim meal expenses and deduct 50% of that claim from their taxable income. There are two ways to calculate your claim, detailed and simplified. The detailed method is done by recording each meal expense and keeping receipts. I will be talking about the simplified method below.

The Canada Revenue Agency will allow you to claim one meal every four consecutive hours, to a maximum of three meals every 24 consecutive hours while travelling for work. Each meal claim is $17, so if you are working away from home base for 24 hours, you can claim $51 in meal expenses (2013 – 2017).

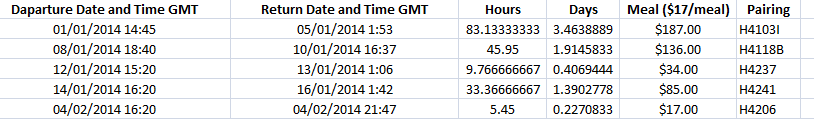

Remember when calculating your meal expenses you must be able to prove that you were at work and for how long. I keep track of my report times, return times, and pairing numbers that I can reference if required. I use an Excel Spreadsheet that calculates everything for me. You can download this spreadsheet at the bottom of this post.

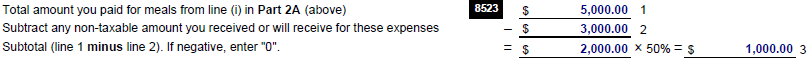

The total amount that you calculate can now be entered into Form TL2 (Claim for Meal and Lodging Expenses). From this amount you must subtract your non-taxed reimbursement, you received from your employer (per diems). Your employer should complete Part 3 of the TL2 form.

Half of what remains is then the amount that can be deducted from your taxable income on line 229 of your tax return. See the example below.

Travelling in the US?

For all the time you are travelling for work in the US, use the same simplified method above but use $17 US for each meal. Using the annual average conversion rate you calculate your US dollars into Canadian dollars. This is the amount that you put into your TL2 form.

For example, in 2016, based on your calculations, you calculate meal expenses as $1,275 USD from work trips to the United States. and $2,550 CND for work trips in Canada. You convert the USD to CND ($1,275 X 1.3248064 = $1,689.13) and add that to your CND for work in Canada ($1,689.13 + $2,550 = $4,239.13). It is this amount ($4,239.13 CND) that you put on your TL2 form.

That rate can be obtained from the Bank of Canada.

Note: The Bank of Canada has changed the way you can find these rates. Follow this link, then click CSV under Annual Average Rates. This will download a confusing spreadsheet of information with all the average rates.

Use The Rates Below at Your Own RISK

- 2016 1.3248064 CND = 1.0 USD

- 2015 1.2787108 CND = 1.0 USD

- 2014 1.1044664 CND = 1.0 USD

- 2013 1.0299148 CND = 1.0 USD

- 2012 0.99958008 CND = 1.0 USD

Excel Spreadsheet UPDATED

Here is an excel spreadsheet that you can use to calculate meal expenses using the simplified method. It has been updated to include travel to the USA.

FAQ

- Do I have to complete a TL2 form and submit it to CRA as part of my taxes?

- No. The purpose of the TL2 form is to claim a tax credit for meal expenses that exceed what your employer has paid you. So, if your airline has paid you more per diems than what you calculated, there is no advantage to submitting this on your taxes.

- I live in Halifax, but am based and start my work in Toronto, can I claim meal expenses for my time travelling to and from Toronto to go to work?

- No. To be eligible for this tax credit, “you regularly have to travel away from the municipality and the metropolitan area (if there is one) where your employer’s relevant establishment (home terminal) is located.” This means, only travel from your base of employment (Toronto) is considered eligible for meal expenses. See more here.

More Information

HI Tom!,

Do you still have that excel spreadsheet for calculating meal expenses?

Thanks!

Janelle

Hi Janelle,

I do! Looks like the link to the file got lost when I moved to a new server last week. I will track down the file, update the link and let you know.

Thanks for letting me know.